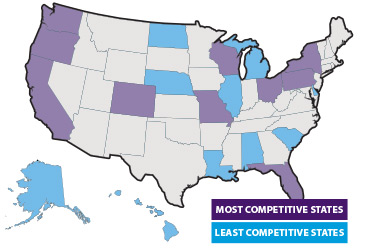

An annual analysis of commercial health insurance markets revealed the 10 most competitive and 10 least competitive states among health insurers. Find out where your state ranks.

In order of most competitive, the 10 top states are:

- Oregon

- Wisconsin

- Pennsylvania

- New York

- Colorado

- Missouri

- Washington

- Ohio

- California

- Florida

The 10 states with the least competitive commercial health insurance markets are:

- Alabama

- Hawaii

- Michigan

- Delaware

- Louisiana

- South Carolina

- Alaska

- Illinois

- Nebraska

- North Dakota

At No. 8, Illinois makes its first appearance in the top 10 least competitive markets this year, displacing Rhode Island from last year’s list. Louisiana entered the top five, moving from ninth on last year’s list.

The 2014 edition of the AMA’s Competition in Health Insurance: A Comprehensive Study of U.S. Markets reports commercial health insurance market shares and federal concentration measures for 388 metropolitan markets as well as all 50 states and the District of Columbia. The study is based on 2012 data captured from commercial enrollment in fully insured and self-insured health plans, and includes participation in consumer-driven health plans.

More findings include:

- In 72 percent of the metropolitan areas studied, there is a significant absence of health insurer competition. These markets are rated “highly concentrated,” based on the guidelines used by the U.S. Department of Justice and Federal Trade Commission to assess the degree of competition in a given market.

- In 17 states, a single health insurer had a commercial market share of 50 percent or more.

- In 45 states, two health insurers had a combined commercial market share of 50 percent or more.

- In 90 percent of metropolitan areas, a single health insurer has at least a 30 percent share of the commercial health insurance market.

This AMA report is intended to help researchers, lawmakers, policymakers and regulators identify markets where mergers and acquisitions among health insurers may cause competitive harm to patients, physicians and employers.

“The AMA is greatly concerned that in 41 percent of metropolitan areas, a single health insurer had at least a 50 percent share of the commercial health insurance market,” said AMA President Robert M. Wah, MD in a news release. “The dominant market power of big health insurers increases the risk of anti-competitive behavior that harms patients and physicians, and presents a significant barrier to the market success of smaller insurance rivals.”

What insurers have the largest market shares?

WellPoint Inc. is the largest private health insurer by market share in more than one in five metropolitan areas.

Soon to be renamed Anthem Inc., WellPoint has a bigger geographic footprint than any other private health insurer in the country, and it holds a market share advantage in more than double the number of metropolitan areas as the next two insurers. Health Care Service Corp. was second, with a market share lead in 37 metropolitan areas, followed by UnitedHealth Group, with a market share lead in 35 metropolitan areas.

A Competition in Health Insurance: A Comprehensive Study of U.S. Markets is available for purchase through the AMA Store; AMA members can access it for free. If you’re not a member, join today.