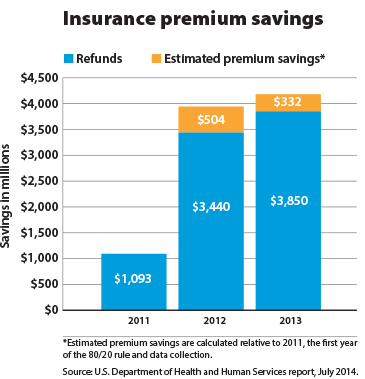

Health insurance companies that spent too little on medical care last year had to refund more than $330 million to consumers by Aug. 1 in order to be compliant with a little-known provision in the Affordable Care Act (ACA). The total payout since 2011 comes to more than $1.9 billion, according a new report from the U.S. Department of Health and Human Services (HHS).

Health insurance companies that spent too little on medical care last year had to refund more than $330 million to consumers by Aug. 1 in order to be compliant with a little-known provision in the Affordable Care Act (ACA). The total payout since 2011 comes to more than $1.9 billion, according a new report from the U.S. Department of Health and Human Services (HHS).

The refunds stem from what is known as the medical loss ratio, or 80/20 rule, which calls for a minimum of 80 percent of insurance premiums to be spent on medical care or activities to improve health care quality. No more than 20 percent can be devoted to administrative costs and profit. In large group markets, the ratio is more stringent, at 85/15.

Based on 2013 spending, health insurers were required to give refunds to 6.8 million consumers. The average refund was $80 per family. Patients should see refunds as a check in the mail, a reimbursement to the account that was used to pay the premium or a direct reduction in their future premiums. If the patient has insurance through their employer, a fourth option is that the employer can apply the refund in a manner that benefits its employees.

The 80/20 rule also has helped to keep premiums more affordable because insurers are required to operate more efficiently than they had prior to this requirement. HHS estimates that if insurers had maintained their 2011 ratios of premiums to spending on medical care, consumers likely would have paid an estimated $3.8 billion in additional premiums last year.

The AMA played a key role in supporting this rule to prevent health insurers from diverting patients’ premium dollars away from medical care.

Through its advocacy efforts to the National Association of Insurance Commissioners, the AMA prevented the health insurance industry from undermining this important patient benefit from the health care law. When this rule was under development, insurers were advocating for provisions that would have allowed them to claim administrative expenses as medical losses, artificially inflate the medical loss ratio and calculate ratios generally at the national level.

More recently, the AMA was instrumental in blocking revisions to the rule that would have provided considerable wiggle room for insurers to reduce their required refund payments and get away with not being fully compliant with the law each year.